You’ve been thinking about it for a while—you’re ready to dive into the investing world. But you don’t know where to start, who to trust, or what type of investment is right for you.

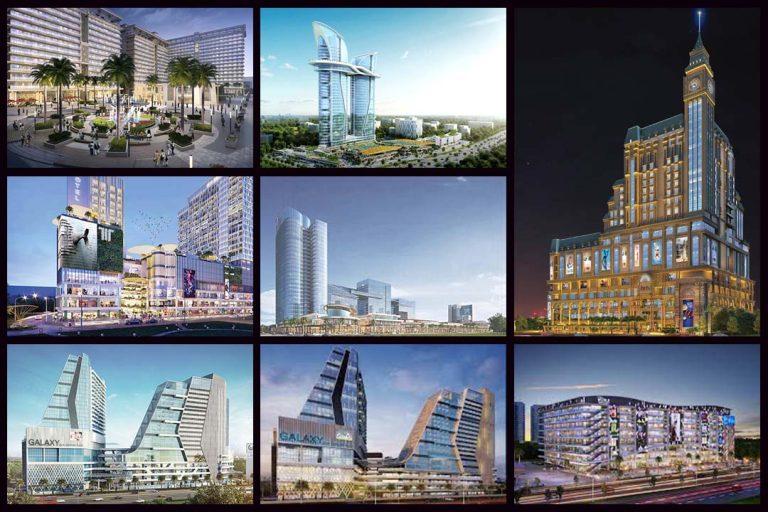

Feeling overwhelmed and intimidated by the unknown is natural, but don’t worry—we’ve got your back. One type of investment is becoming increasingly popular in commercial real estate. If this option interests you, we’ve got some essential tips to help you get started. Many good commercial projects in Greater Noida can be an excellent opportunity to invest in.

We’ll discuss both the pros and cons of investing in commercial real estate and critical considerations and steps you should take before investing. So if you’re ready to learn more and prepare yourself for success, let’s dive in!

Definition of Commercial Projects

Before investing in commercial projects, it’s essential to understand what they are and whether or not they fit your investment strategy.

Put, commercial projects are real estate investments that fall under income-producing properties. These projects are typically larger in scale than residential real estate, offer higher returns, and have a more significant potential for long-term growth. Examples of commercial projects include shopping malls, healthcare facilities, hotels, office buildings, and multi-unit dwellings like apartment complexes or condominiums.

Furthermore, commercial projects usually require more resources upfront than residential investing, thus a more significant financial commitment. That’s why it’s essential to carefully weigh all your options before committing to a particular project.

Understand Project Specifics

When investing in a commercial project, you want to understand the project’s specifics fully. Research the location and determine what type of people will likely use and visit the space. Think about potential business prospects and their needs. Will current businesses be able to draw customers to the site? This is an important consideration when purchasing a business property.

In addition, research any applicable regulations which may influence your venture. Before investing, you must know all of the rules related to zoning laws, environmental regulations, building codes, etc. Knowing what’s allowed will help you make informed decisions on how best to proceed and ultimately maximize profits.

Consider the Economic Environment

Before leaping into a commercial real estate project, thinking critically about the economic environment is essential. Is the market likely to go up or down in 6 months? A year? Five years? Are there any imminent changes that might affect price points or tenant demand?

Location

Location can make or break an investment, so you must consider where the property is and what it’s near – schools, transportation, shopping centres, and other amenities will influence the market value of a building. An area with plenty of job opportunities will help draw tenants for years to come and make sure that you have high occupancy rates.

Advantages

What advantages does your potential property offer? Consider what makes it different from all others in its class—is there something special about this building or location that guarantees its value? That could be anything from water views to access to public transportation.

Research the Location

Before you invest, it’s essential to research the location of the commercial project. Completing your homework might help you avoid making costly mistakes in the future.

Here are some factors to consider when researching a potential location:

● Are the necessary infrastructure and resources available?

● Is the local government supportive?

● What is the local economy like?

● Is there enough local demand for your product or service?

● How accessible is the area for transportation and shipping?

Conclusion

Investing in commercial projects can be a great way to make money and build wealth. Before you invest:

-

- Make sure you fully understand the potential risks and rewards of the project.

-

- Have a clear plan for project completion.

-

- Have analyzed the local market.

-

- Know the zoning requirements and regulations.

-

- Assess your liquidity and cash flow to figure out what you can afford.